Mathematical Modeling in Finance

Faculty Director: Prof. Andreea Minca

Department: School of Operations Research & Information Engineering, Cornell University

Andreea Minca is an Associate Professor in the School of Operations Research and Information Engineering at Cornell University. Andreea Minca received her PhD in Applied Mathematics from the University Paris 6 Pierre et Marie Curie in 2011. She studies financial systems and uses mathematical modeling to derive optimal policies that promote system stability. In recognition of her fundamental research contributions to the understanding of financial instability, quantifying and managing systemic risk, and the control of interbank contagion, Andreea Minca received the 2016 SIAM Activity Group on Financial Mathematics and Engineering Early Career Prize. She is also a 2014 GARP Fellow and the recipient of an NSF CAREER Award.

Project Description

The mathematical modeling revolution in finance started with the celebrated Black and Scholes formula. Since then, the financial industry has relied on mathematicians and engineers to “price” the risks underlying various financial products.

The mathematical modeling revolution in finance started with the celebrated Black and Scholes formula. Since then, the financial industry has relied on mathematicians and engineers to “price” the risks underlying various financial products.

During our modules, students were introduced to the concepts of dealing with uncertainty in finance and basic probabilistic and optimization tools. We explained the concept of hedging the risk, which can be introduced through elementary mathematics. Also, we explored examples in which risk cannot be hedged.

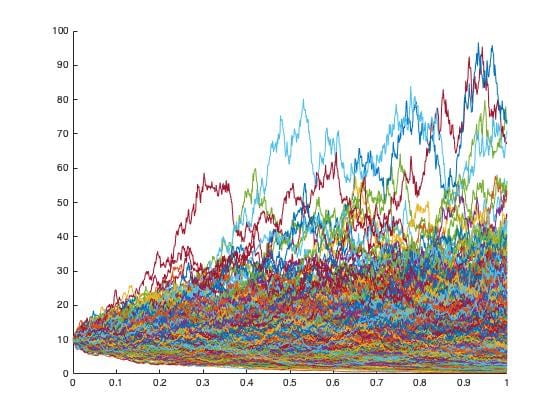

We developed a game in which students constructed portfolios of assets and simulated portfolio trajectories under different scenarios. The students learned how to evaluate portfolio performance, and measured the risks in their position.

Note: The 2020 project was held online and this project was adapted.